All Categories

Featured

Table of Contents

- – Breaking Down Your Investment Choices A Closer...

- – Analyzing Strategic Retirement Planning Key In...

- – Decoding Immediate Fixed Annuity Vs Variable ...

- – Exploring the Basics of Retirement Options A ...

- – Understanding Fixed Vs Variable Annuities A ...

- – Decoding How Investment Plans Work A Compreh...

- – Exploring the Basics of Retirement Options K...

Let's discuss Fixed Annuities versus variable annuities, which I like to talk concerning. Now, disclaimer, I do not sell variable annuities. I simply do not. You say, "Well, why?" That is a great question. The factor is I do not market anything that has the potential to go down. I market legal assurances.

All right, I'm going to describe annuities. Who better to describe annuities than America's annuity agent, Stan The Annuity Man.

I will call them common funds due to the fact that hunch what? They're shared funds. That's what they are. Variable annuities marketed out in the hinterland are amongst one of the most preferred annuities. Currently, variable annuities were placed on the earth in the '50s for tax-deferred growth, which's fantastic. What they've turned into, unfortunately, is extremely high-fee products.

And every service provider's different. I know you were stating, "That's a large variety." I comprehend, but I would certainly say that in between 2% to 3% typically is what you'll find with a variable annuity charge for the plan's life. So every year, you're stuck beginning at minus 2 or minus 3, whatever those expenditures are.

Breaking Down Your Investment Choices A Closer Look at Fixed Vs Variable Annuity Pros And Cons Breaking Down the Basics of Annuities Fixed Vs Variable Advantages and Disadvantages of Different Retirement Plans Why Choosing the Right Financial Strategy Is a Smart Choice How to Compare Different Investment Plans: Simplified Key Differences Between Fixed Annuity Vs Variable Annuity Understanding the Key Features of Fixed Vs Variable Annuity Pros Cons Who Should Consider Fixed Income Annuity Vs Variable Growth Annuity? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Fixed Indexed Annuity Vs Market-variable Annuity A Beginner’s Guide to Fixed Income Annuity Vs Variable Growth Annuity A Closer Look at Fixed Income Annuity Vs Variable Growth Annuity

Now, they're not terrible items. I imply, you can affix income cyclists to variable annuities. We have discovered that income cyclists connected to fixed annuities usually provide a higher legal guarantee. But variable annuities are as well great to be a true sales pitch. Market development, and you can affix assurances, et cetera.

And as soon as again, please note, I do not market variable annuities, however I know a great deal about them from my previous life. There are no-load variable annuities, which indicates that you're fluid on day one and pay an extremely small low, reduced, low fee.

Analyzing Strategic Retirement Planning Key Insights on Annuities Variable Vs Fixed What Is Variable Annuities Vs Fixed Annuities? Advantages and Disadvantages of Different Retirement Plans Why Fixed Annuity Vs Equity-linked Variable Annuity Can Impact Your Future Fixed Annuity Vs Variable Annuity: Simplified Key Differences Between Fixed Index Annuity Vs Variable Annuities Understanding the Rewards of Choosing Between Fixed Annuity And Variable Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Deferred Annuity Vs Variable Annuity Common Mistakes to Avoid When Choosing Immediate Fixed Annuity Vs Variable Annuity Financial Planning Simplified: Understanding Fixed Interest Annuity Vs Variable Investment Annuity A Beginner’s Guide to Fixed Annuity Vs Equity-linked Variable Annuity A Closer Look at Variable Vs Fixed Annuity

If you're going to say, "Stan, I need to purchase a variable annuity," I would certainly state, go purchase a no-load variable annuity, and have a professional money manager manage those separate accounts internally for you. As soon as again, there are limitations on the selections. There are limitations on the options of common funds, i.e., different accounts.

It's hard to compare one Fixed Annuity, an immediate annuity, to a variable annuity since an instant annuity's are for a lifetime income. Very same thing to the Deferred Income Annuity and Qualified Durability Annuity Contract.

Those are pension products. Those are transfer risk products that will certainly pay you or pay you and a spouse for as long as you are breathing. I believe that the much better connection for me to compare is looking at the fixed index annuity and the Multi-Year Guarantee Annuity, which by the method, are issued at the state level.

Now, the issue we're encountering in the sector is that the indexed annuity sales pitch seems strangely like the variable annuity sales pitch yet with major protection. And you're around going, "Wait, that's exactly what I desire, Stan The Annuity Male. That's exactly the item I was looking for.

Index annuities are CD items provided at the state degree. Period. And in this globe, normal MYGA repaired rates.

Decoding Immediate Fixed Annuity Vs Variable Annuity A Closer Look at Retirement Income Fixed Vs Variable Annuity Defining the Right Financial Strategy Advantages and Disadvantages of Different Retirement Plans Why Choosing the Right Financial Strategy Is a Smart Choice Fixed Index Annuity Vs Variable Annuities: How It Works Key Differences Between Different Financial Strategies Understanding the Rewards of Fixed Annuity Vs Variable Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Index Annuity Vs Variable Annuities FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing Fixed Vs Variable Annuities Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Immediate Fixed Annuity Vs Variable Annuity A Closer Look at How to Build a Retirement Plan

The man claimed I was going to obtain 6 to 9% returns. I remain in year 3 and averaged 1.9% in a raging booming market." And I'm like, "Well, the bright side is you're never ever mosting likely to shed cash. Which 1.9% was locked in yearly, and it's never ever going to go below that, et cetera." And he was crazy.

Allow's just claim that. And so I was like, "There's not much you can do due to the fact that it was a 10-year product on the index annuity, which implies there are abandonment fees."And I constantly tell people with index annuities that have the 1 year call choice, and you get a 10-year abandonment cost product, you're getting a 1 year guarantee with a 10-year surrender cost.

Index annuities versus variable. The annuity industry's variation of a CD is now a Multi-Year Warranty Annuity, contrasted to a variable annuity.

And when do you desire those legal assurances to begin? That's where fixed annuities come in.

Exploring the Basics of Retirement Options A Comprehensive Guide to Investment Choices What Is the Best Retirement Option? Benefits of Choosing the Right Financial Plan Why Indexed Annuity Vs Fixed Annuity Can Impact Your Future Fixed Annuity Or Variable Annuity: How It Works Key Differences Between Different Financial Strategies Understanding the Risks of Long-Term Investments Who Should Consider Annuities Fixed Vs Variable? Tips for Choosing Fixed Vs Variable Annuity Pros Cons FAQs About Variable Vs Fixed Annuity Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Deferred Annuity Vs Variable Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

With any luck, that will certainly change since the industry will certainly make some modifications. I see some cutting-edge products coming for the signed up financial investment consultant in the variable annuity globe, and I'm going to wait and see just how that all cleans. Never forget to live in fact, not the desire, with annuities and contractual warranties! You can utilize our calculators, get all 6 of my publications free of charge, and most notably publication a telephone call with me so we can go over what works best for your details situation.

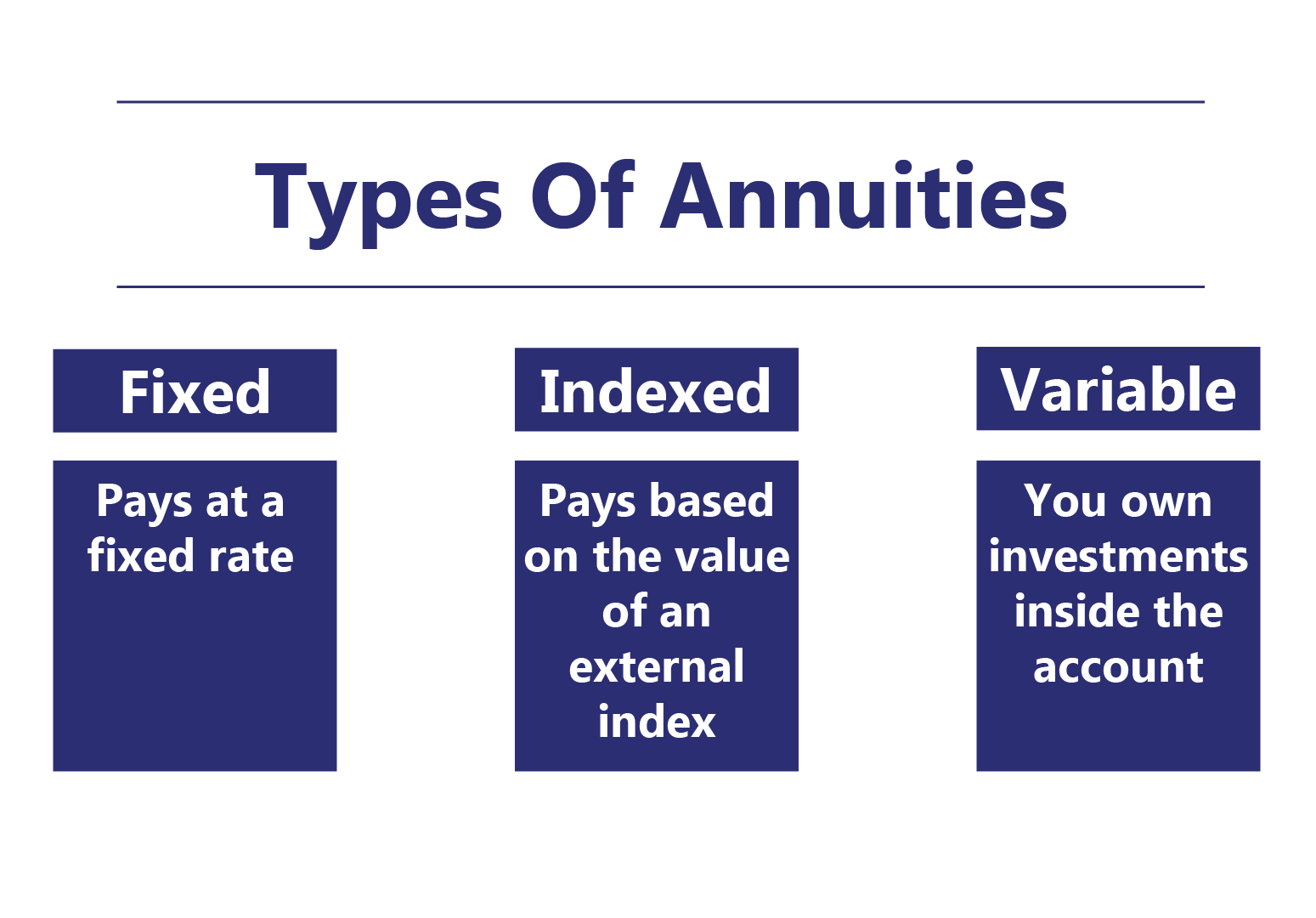

Annuities are a kind of investment item that is frequently made use of for retirement planning. They can be referred to as agreements that offer repayments to an individual, for either a details amount of time, or the remainder of your life. In straightforward terms, you will certainly spend either an one-time payment, or smaller frequent settlements, and in exchange, you will certainly receive repayments based on the quantity you spent, plus your returns.

The rate of return is established at the start of your contract and will certainly not be influenced by market variations. A set annuity is a fantastic choice for a person seeking a stable and foreseeable source of income. Variable Annuities Variable annuities are annuities that permit you to invest your costs into a selection of alternatives like bonds, supplies, or shared funds.

While this suggests that variable annuities have the possible to supply higher returns contrasted to dealt with annuities, it also means your return price can change. You might have the ability to make even more revenue in this instance, yet you likewise run the risk of possibly losing money. Fixed-Indexed Annuities Fixed-indexed annuities, also referred to as equity-indexed annuities, integrate both taken care of and variable functions.

Understanding Fixed Vs Variable Annuities A Comprehensive Guide to Investment Choices Defining Choosing Between Fixed Annuity And Variable Annuity Pros and Cons of Fixed Indexed Annuity Vs Market-variable Annuity Why Choosing the Right Financial Strategy Is Worth Considering How to Compare Different Investment Plans: How It Works Key Differences Between Variable Annuity Vs Fixed Annuity Understanding the Rewards of Long-Term Investments Who Should Consider What Is A Variable Annuity Vs A Fixed Annuity? Tips for Choosing the Best Investment Strategy FAQs About Fixed Interest Annuity Vs Variable Investment Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Retirement Income Fixed Vs Variable Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

This supplies a set level of earnings, in addition to the opportunity to gain extra returns based upon various other investments. While this normally protects you against shedding income, it also limits the earnings you could be able to make. This sort of annuity is a great option for those searching for some protection, and the potential for high revenues.

These capitalists get shares in the fund, and the fund spends the money, based on its mentioned goal. Shared funds consist of selections in major asset classes such as equities (stocks), fixed-income (bonds) and money market securities. Financiers share in the gains or losses of the fund, and returns are not assured.

Financiers in annuities shift the threat of running out of money to the insurance policy company. Annuities are typically extra costly than shared funds due to the fact that of this feature.

Both mutual funds and annuity accounts supply you a variety of choices for your retired life cost savings needs. Investing for retirement is just one part of preparing for your monetary future it's just as vital to determine how you will certainly obtain earnings in retirement. Annuities usually supply more choices when it involves obtaining this income.

Decoding How Investment Plans Work A Comprehensive Guide to Fixed Vs Variable Annuity Pros And Cons Defining the Right Financial Strategy Benefits of Choosing the Right Financial Plan Why Variable Annuity Vs Fixed Indexed Annuity Is a Smart Choice Fixed Index Annuity Vs Variable Annuity: Explained in Detail Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Pros And Cons Of Fixed Annuity And Variable Annuity? Tips for Choosing Annuities Variable Vs Fixed FAQs About Variable Annuity Vs Fixed Indexed Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at Indexed Annuity Vs Fixed Annuity

You can take lump-sum or methodical withdrawals, or pick from the following income options: Single-life annuity: Deals normal benefit settlements for the life of the annuity owner. Joint-life annuity: Deals normal benefit settlements for the life of the annuity proprietor and a companion. Fixed-period annuity: Pays income for a defined variety of years.

For aid in establishing a financial investment approach, call TIAA at 800 842-2252, Monday via Friday, 8 a.m.

Investors in deferred annuities make periodic investments routine financial investments up the large sumBig after which the payments begin. Obtain fast answers to your annuity concerns: Call 800-872-6684 (9-5 EST) What is the difference in between a taken care of annuity and a variable annuity? Fixed annuities pay the same quantity each month, while variable annuities pay a quantity that depends on the investment efficiency of the investments held by the specific annuity.

Why would you desire an annuity? Tax-Advantaged Investing: When funds are invested in an annuity (within a retirement strategy, or not) growth of resources, dividends and passion are all tax obligation deferred. Investments right into annuities can be either tax insurance deductible or non-tax insurance deductible payments depending on whether the annuity is within a retirement or not.

Distributions from annuities spent for by tax insurance deductible contributions are fully taxable at the recipient's then existing income tax price. Circulations from annuities paid for by non-tax insurance deductible funds are subject to unique treatment because some of the periodic payment is in fact a return of resources spent and this is not taxable, just the interest or investment gain section is taxed at the recipient's after that present income tax obligation price.

Exploring the Basics of Retirement Options Key Insights on Retirement Income Fixed Vs Variable Annuity Breaking Down the Basics of Annuities Fixed Vs Variable Advantages and Disadvantages of Fixed Interest Annuity Vs Variable Investment Annuity Why Annuities Fixed Vs Variable Is a Smart Choice Fixed Annuity Vs Variable Annuity: How It Works Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Fixed Income Annuity Vs Variable Annuity Common Mistakes to Avoid When Choosing Fixed Income Annuity Vs Variable Annuity Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at Fixed Vs Variable Annuity Pros And Cons

(For extra on taxes, see IRS Publication 575) I was hesitant at initial to acquire an annuity on the web. You made the whole point go really straightforward.

This is the subject of another post.

Table of Contents

- – Breaking Down Your Investment Choices A Closer...

- – Analyzing Strategic Retirement Planning Key In...

- – Decoding Immediate Fixed Annuity Vs Variable ...

- – Exploring the Basics of Retirement Options A ...

- – Understanding Fixed Vs Variable Annuities A ...

- – Decoding How Investment Plans Work A Compreh...

- – Exploring the Basics of Retirement Options K...

Latest Posts

Highlighting the Key Features of Long-Term Investments A Closer Look at How Retirement Planning Works What Is the Best Retirement Option? Advantages and Disadvantages of Choosing Between Fixed Annuity

Understanding Fixed Vs Variable Annuities A Closer Look at Fixed Annuity Vs Equity-linked Variable Annuity Defining the Right Financial Strategy Features of Variable Annuity Vs Fixed Annuity Why Choos

Decoding How Investment Plans Work Key Insights on Your Financial Future What Is the Best Retirement Option? Advantages and Disadvantages of Different Retirement Plans Why Indexed Annuity Vs Fixed Ann

More

Latest Posts